A New Year In Airdrop Land Has Begun

2025 is the year of the TGE

Saying the past few weeks in airdrops were busy is an understatement. Broadly, there has been some market chopping (in part thanks to Mr. Powell).

However, this has not stopped projects from conducting TGEs, launching NFTs, and much more.

Are NFTs + Airdrop Back?

Let’s dive into NFTs first, they are back and bigger than ever.

A Pudgy Penguin recently became more valuable than 1 BTC. Part of this is due to the launch of the $ PENGU token.

The token was airdropped to a huge number of wallets, including wallets that had older Solana transactions.

People earning 3 or 4 figures without even holding eligible NFTs emphasizes the importance of an on-chain footprint.

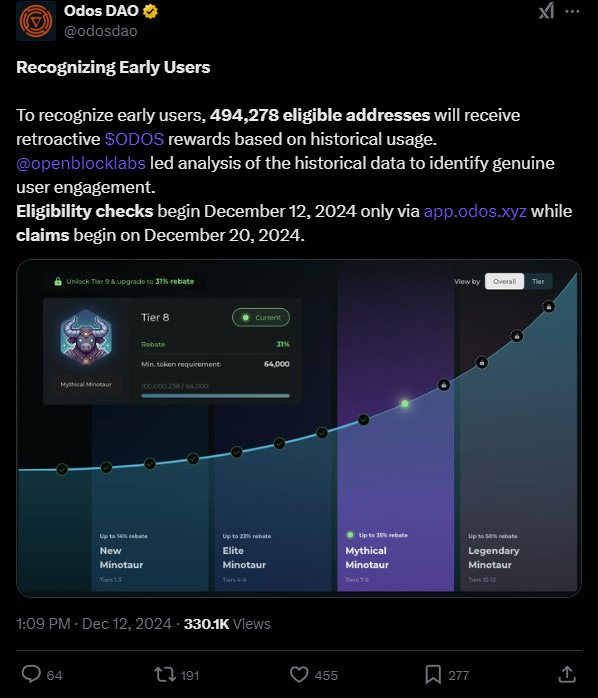

Note, there are other projects that just launched like Odos that also reward you for consistent on-chain activity.

This also highlights the “passive farm” opportunities at play where it is +EV to use good products that are also tokenless especially in the interoperability category (Jumper/LIFI, Mayanswap, Relay, Squidrouter, Bungee,

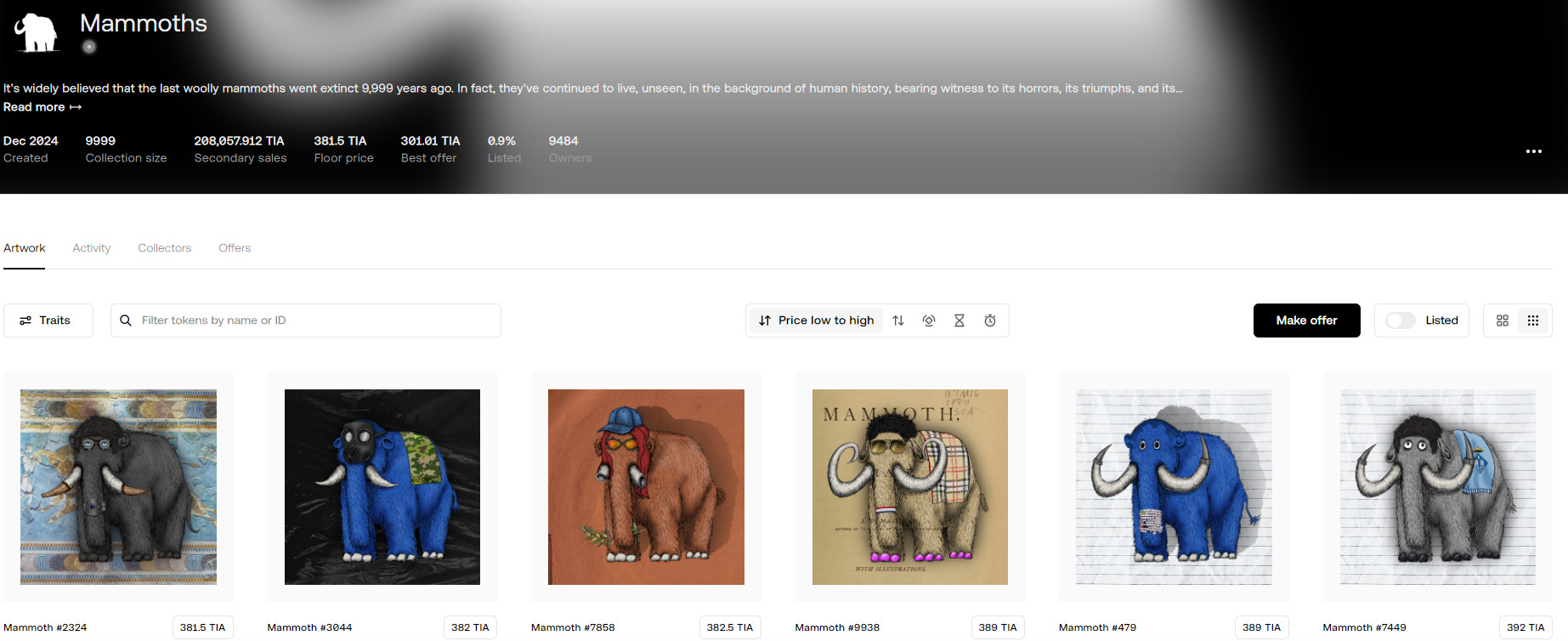

The Cosmos ecosystem also has had massive success with their NFTs and the Mammoths launching. Mammoths launched at 0.75 TIA with floor price now being ~380 TIA.

The reason behind the mammoths success is they are being viewed as a possible equivalent of Celestine Sloths. WL for Mammoths was awarded to loyal users of the Modularium launchpad, giving WLs to users who held 2-5 different collections.

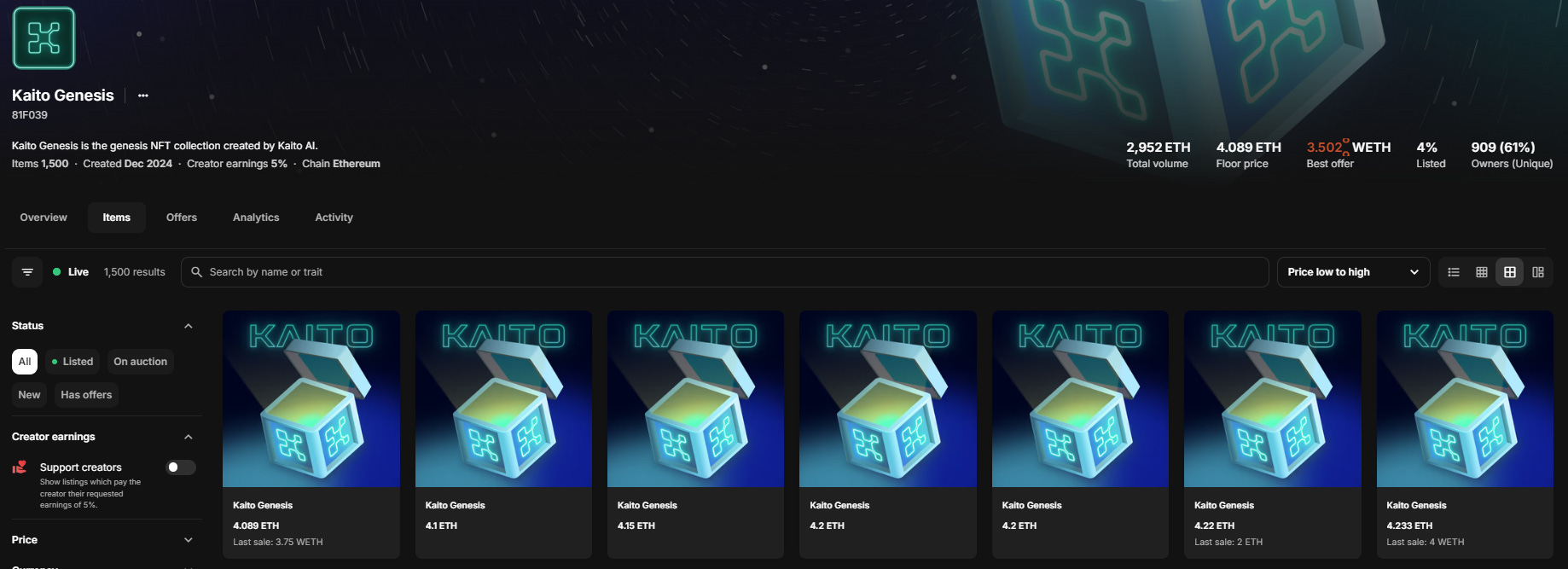

Kaito is the “next Hyperliquid”

Kaito AI, a crypto analytics data tool, has been on an absolute tear. They just launched their Yaps program where you can earn points just for talking on Twitter.

The process of earning yaps is quite difficult, but it has been proven that the size of your account doesn’t negate your ability to earn them.

They also just launched an NFT with early users being whitelisted. This NFT is now worth ~4ETH. If you’re interested in signing up, literally zero cost, you can use this link.

I recommend you read through this recent article made by Lamboland “Kaito - The Biggest Opportunity for Creators in 2025” for why you should be getting involved in Kaito even if you are a smaller creator

Ton chain and TG mini app are cooked ?

Personally, I am not an expert on TG apps and not generally bullish due to how easy they are to mass sybil

However, there are exception like we saw with Vana appearing to be one of the first ones to majorly cook. In my opinion, a better TG opportunity than clicker apps is using good products that your going to use anyways like BullX for example.

Speaking of Telegram, an interesting note is that the TON ecosystem in general has underperformed and not seen much success lately with minimal participation in their campaigns and high transaction fees.

Short sidenote on OP and superchains

I continue to be a fan of the OP team and the Superchain. There are a couple rewards that came out this week including some retroactive Zora and Phi rewards.

However, CT has expressed continuous disapproval of Zora as users feel milked and even needed to KYC for these rewards (something very rare).

Another chain on the Superchain, Mode, has been rising from the ashes with a strong AI focus which may be worth taking a deeper look at.

Also, Ink (Kraken’s L2) just launched on the Superchain and you can bridge ETH over using Merkly’s Hyperlane bridge as well as mint their native LST, iETH, on Dinero.

Reviewing the Fuel airdrop

Other airdrop claims and announcements recently include some notable names being Fuel and Usual.

Fuel heavily rewarded NFT collections with many people receiving 20k+ FUEL just for holding a $20 NFT.

They also had a number of token sales at $200m FDV, 80% lower than their last raise at $1B, giving and average of 2x for certain tiers of users (S1/ early bridge participants, ect) who were given access and were able to participate in the public pre-sale.

Although this airdrop allowed people to make generous returns, there are some flaws in my mind around the distribution.

Firstly, rewarding NFTs much heavier provides DeFi and volume farmers less incentive to actually interact on the chain, reducing the chain’s usage and desire for development on the chain.

Secondly, although people who purchased the presales are still more than tripling their money at the current valuation, I believe this ‘cheap’ token sale led to people thinking that Fuel isn’t worth the valuation it previously raised.

I’m hoping Fuel sees this similarly and I still see potential for Fuel due to its high community allocations in its tokenomics.

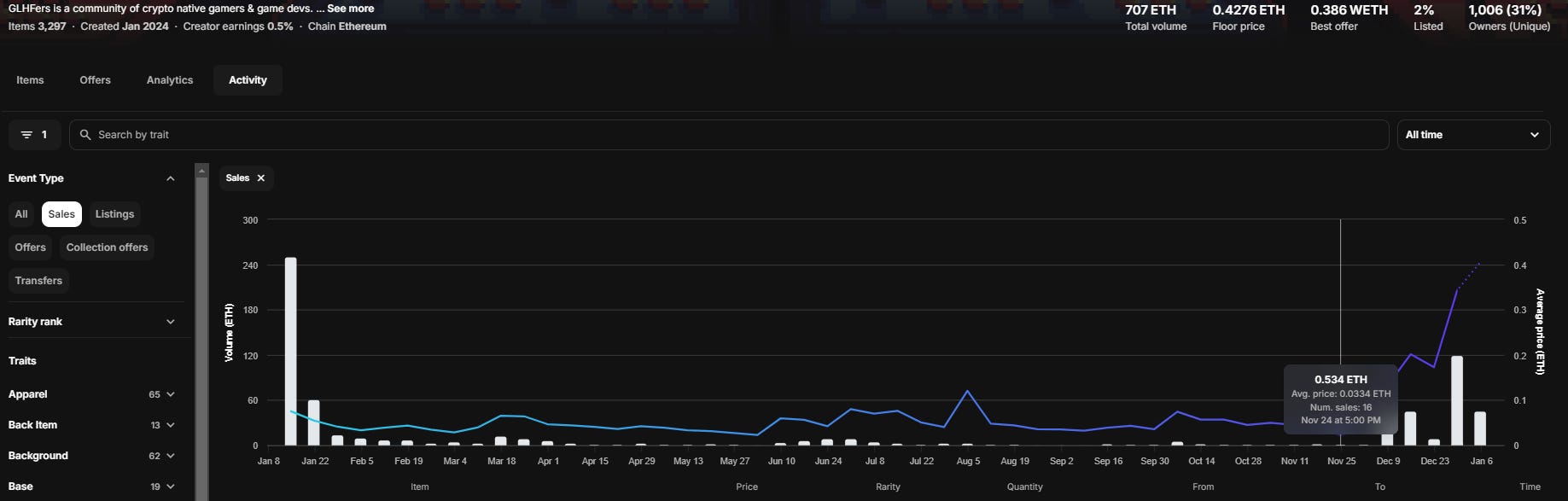

Eclipse + A rerun of the Fuel playbook?

A newer mainnet that still has great potential is Eclipse, they have $60M+ in funding, a strong narrative (Solana on Ethereum), hyped NFT collections (like ASC), and Hyperlane integrations for bridging in and out.

In my opinion it is underfarmed due to 1. There aren’t too many dapps live yet 2. The only wallet people are using is Backpack, once Phantom onboards Eclipse I think we will see a large wave of new users. Here is a brief guide from FLB on simple activities to perform on Eclipse and another one pager guide from myself.

This has caused further price appreciation for NFTs in other ecosystems such as the Validators (floor ~0.22 ETH) and ASC (floor ~0.67 ETH) collections on Eclipse as people are speculating that a similar NFT allocation playbook that happened on Fuel will also happen on Eclipse.

Imo a lot of the “easy” repricing that has already happened for ASC has already and unless you have deeper pockets I wouldn’t recommend see as you could get “relatively” more tokens if you buy one of the “3rd place” or lower NFTs on Eclipse for $25, or try to play “middle of the road” by going with a Vaildators NFT for ~0.22 ETH

Stablecoin airdrop updates

Usual cooked, that’s all there is to say. They provided incredible returns (some earning 10-20x) for everyone who used Usual stablecoins in DeFi and we saw a return of profitable Pendle YT farming.

Anzen also dropped recently and their token has performed extremely well. There is speculation that Resolv Labs might be the next solid stablecoin airdrop, check out their platform here.

Hyperlane

Still one of my favorite projects at the moment is Hyperlane.

The team is helping launch new routes seemingly every week, and Hyperlane now connects more chains than LayerZero whilst pushing new tech such as Eco routes

The project also benefited from Mammoths as a Hyperlane bridge is commonly used to get to Forma (the chain for the Mammoths NFTs).

I’m extremely bullish on Hyperlane, I just hope they pick strong tokenomics and have good market timing for their TGE.

Meteora

Meteora continues to garner attention on the timeline with various strategies.

The most consistent seems to be providing liquidity when new tokens launch. I tried this during the Pengu launch with 5 SOL and my pengu airdrop and generated good fees with minimal impermanent loss.

Also, I just bought and staked some M3M3 (Meteora’s product) as a speculative airdrop multiplier.

Testnets

With the recent success of the Movement testnet and many large networks launching soon (Story, Monad, Berachain, etc.) there has been a renewed interest in testnets.

Firstly, we have Story Protocol an IP focused L1 with 9 figure funding who recently completed a badge campaign on their testnet. Although this is over, their testnet is still live and you can grind in their Discord for an OG role.

Abstract Chain + Positioning for Gigaverse mint

Abstract, the NFT chain, has been getting a lot of attention. The team made it fairly explicit that testnet metrics won’t matter, the focus here is NFTs.

If you are looking for exposure you better start grinding for whitelists for projects like Kabu or Ruyui.

If you have a decent on-chain footprint I would join the playgigaverse discord here

Their genesis collection has run up from 0.03 ETH to 0.43 ETH since more attention and hype has drawn towards them with some insider wallet clearly accumulating before hand.

There are a few ways you can get WL

Keep reading with a 7-day free trial

Subscribe to Insightful Insiders to keep reading this post and get 7 days of free access to the full post archives.