How To "Win" At Airdrops - Part 1

The first in a small series of teaching you 'how to fish" instead of being forever reliant on influencers

Small insert at the start here if you are a project and are interested in partnering with me for a sponsored spot to feature your project here over at the Insightful Insiders Newsletter reach out to me via twitter and if its a good fit well see how we can work together

2024 will be the year of airdrops

The opportunity is gradually closing In 1+ years from now there will be more bots, retails tools, awareness and competition than ever before

Don't squander your limited edge make the most use of your time now

In this post I’ll be going over:

• Why spend time doing airdrops, the pros and cons

• Why projects will continue to airdrop

• How to decide what to farm/focus your time on and why

• How to decide what to fade or lower in your priority

Airdrops are admittingly much better as a "Bear market activity" -> gas is low, attention and competition can be lower but there are still several worthy positives to take advantage of as well

Pros

Arguably very good risk/reward (compared to other way to make money in crypto) can make 10x-30x with very little capital investment

Ex. with arb you could have spend ~30$ from bridging and txn fees and relatively easily hit the minimum allocation of ~$600 Good for people who are time “rich” but capital “poor

Build out a “high quality” history of wallets across multiple chains = potentially qualifying for future airdrops (Ex. Celestia’s $TIA). Your high quality wallets are actually assets if you think about it, you should be treating them this way

Cons

Can be very time consuming, monotonous and boring

Most dont have the skills to create automation software (and trusting a 3rd party software means you cant guarantee control of the private keys/wallet control)

Capital wasted on gas fees, slippage, inefficient routes

Requires highest level of delayed gratification in crypto For most projects it takes ~3 years before TGE (token drop) from the projects inception (first phases of testnet)

Farming windows can last 6-12+ months (usually average 3-4 months roadmap delays commonly seen in crypto)

Constant uncertainty of no guarantee of reward or that it was worth the money and time invested (uncertainty can also be an edge you have if you do background research and have high conviction in farming a certain project)

Lots of noise/info dilution from engagement farmer threadoooors or projects doing “community tasks” pointless galxe nft campaigns ect = easy to get overwhelmed/distracted

Why projects will continue to airdrop?

strong organic marketing flywheel

farming speculation = more fees/activity/TVL generated which can = higher valuation

- Gives VCs an exit which creating a decentralized and community owned network

image credits to CC2

How to pick what to farm?

Does the product offer something innovative/unique to the market (not just another fork)

How much money was raised what is the FDV/valuation placed upon the project by VCs (min 5M raised, ideally 20M+)

Will the market value this project around the FDV from VCs what is the FDV of its closest comparables

hints/ possible indication (but no confirmation) of an airdrop = points system, “need to decentralize the network”, “enrich/reward/empower the community”

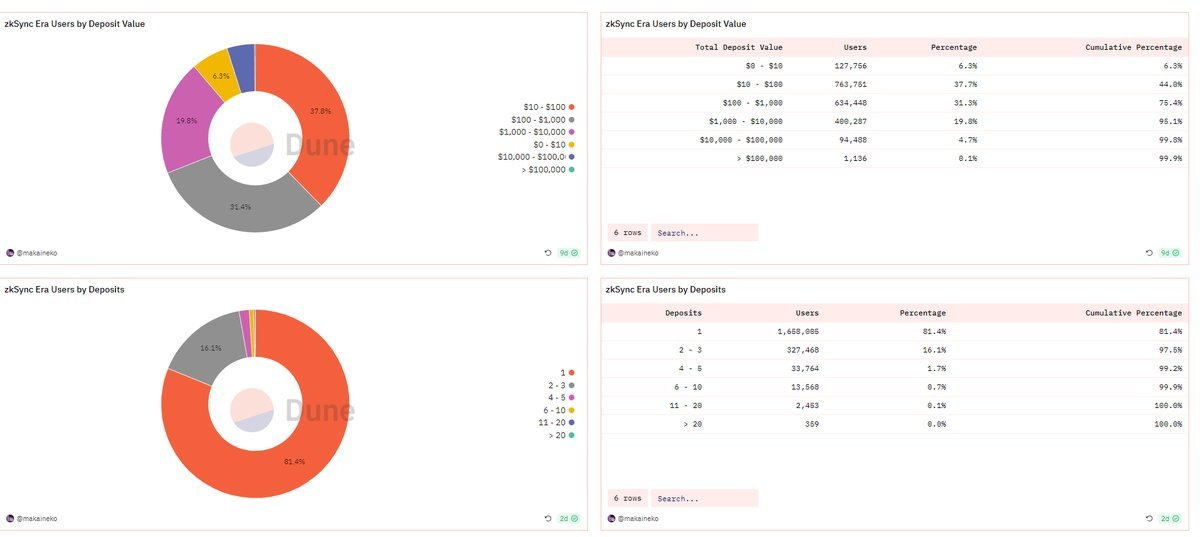

How much money and time will it take me to be within the top 10-20% of wallets compared to other opportunities

How many other wallets/users am I competing with?

What is the average “quality” of these wallet (X amount of volume, txns, unique contracts, ect)

For example in this post I broke down all of the wallet metrics between the largest most farmed L2s to see which ones you could argue were objectively “underfarmed”

What are other credible people in the niche putting their time and capital into, what is their conviction level in what they are farming

Is this worth farming, generally airdrop value is: FDV + total supply % allocation towards airdrop, the higher the FDV or supply % given to

the airdrop the more valuable it will be. (generally you’ll never know the % until release but you want it to be at least 5%-11% of total supply)

For context Arbitrum (most lucrative drop in last 12-18 months) was roughly 2B FDV with 11% of the supply dropped

How to decide what to fade/lower priority?

Product doesnt/hardly functions (Ex. shardeum testnet)

Overly aggressive engagement farm campaigns to milk network activity, attention and capital (from NFT events) from users (Ex. Sei)

Preemptively & very aggressively advertising an airdrop early on and continuously advertising it to attract and retain users

Funding or FDV is low to comparable projects within that niche

Too time or capital intensive (Ex. needing to LP $10k+ for several months to compete/qualify)

Lack in transparency from the team or higher risk of smart contract exploits (money lending markets are much more complicated smart contract wise, thus much more likely to get exploited than your average DEX)

This is long enough or Part 1 stay posted for part 2 and more when I'll go over topics such as:

• Where Im focusing my time and why

• How to craft a route and farm more efficiently with examples provided

• How to decide how much to farm/what thresholds you need and more

Thanks man for a great work. You introduce me into new farming world :)

Nice one Insightful

Can’t wait for Part 2