We have had our fair share of disappointing airdrops recently. Laughably low allocations, locked tokens & questionably scaled pie charts have some of us asking “is the airdrop meta over already?”

I am seeing farming fatigue and low morale across the timeline. Farmers accustomed to “easy mode” can barely be bothered to keep clicking. Everything is diluted, the VCs have won. The apathy of our weak willed competitors is our advantage.

Easy mode may be winding down but if you are willing to put in the extra work to step outside of your comfort zone I believe there are still plenty of fresh fields to plough.

I have no doubt that we will see more massive airdrops before the year is over. This could come from a completely unexpected source based on past on-chain activity like we saw with $TIA and $PYTH or it could come from an undervalued opportunity the masses are fading.

There is no doubt farmers have been dealt a series of bad hands by greedy protocols making a mockery of “the path to decentralization”. Hoarding their tokens and offering only a pittance to the community.

The gloom from wasted time and resources is causing a decent subsection of airdrop farmers to give up at a crucial point before harvest season. It will only take one big drop or one protocol that rewards their users generously before everyone wishes they had been hard at work instead of sleeping on the job.

The days of staking 1 $TIA or $JTO for thousands in a free money glitch may be largely behind us. Does that mean I am going to slow down on interacting with tokenless protocols on a potential path to decentralization? Yah nah. I worked a lot harder than this for a lot less reward before web3.

My goal with this week’s newsletter is to inspire you to step outside of your comfort zone to expand your horizons and find the next opportunity. You might need to learn a new ecosystem, make a new wallet or place a calculated bet on a less than sure thing. You might have to fight exhaustion and take a few more swings despite recent strikeouts.

Easy mode might be over but there are still under farmed opportunities. We sleep in the bear…if we sleep at all.

1/ Aptos ecosystem + Pontem Network

If you followed my earlier guide to “finding the edge outside the EVM bubble” you should already be on this. If you haven’t started because you were to lazy didn’t have time to make a Pontem or Petra wallet there is no time like the present to get started.

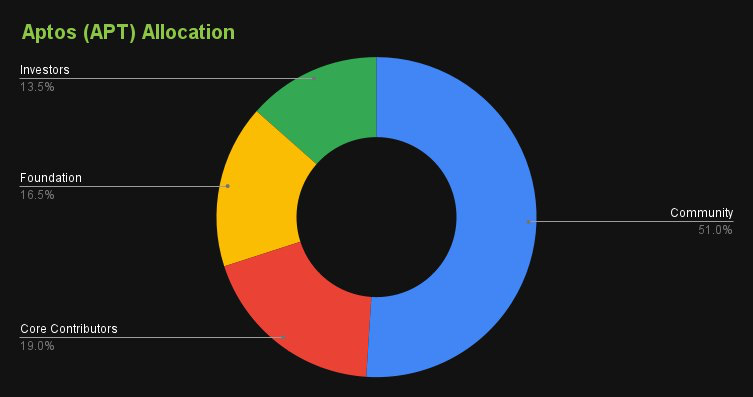

Aptos has currently only distributed 2% of a very generous 51% to the community. I would expect a significant airdrop from this top 30MC coin this year. There are also several tokenless protocols worth interacting with.

Fund the wallet via the Liquidswap (Pontem) bridge (Uses Layer Zero)

Swap tokens using Liquidswap once or twice a week. Try and build to 1k then 10k+ volume if possible. Liquidswap will be launching their own L2 and should be the primary farm on Aptos.

The Aptos bridge is relatively cheap so you can always bridge 90% of your funds back and forth if you are low on liquidity (and start farming L0 S2).

Optionally provide some Liquidity.

Stake some $APT (12+ would be decent). Keep an eye on any chance to vote on governance proposals.

Sign up for the Airdrop. You can see that holding any amount of Aptos memecoins fulfills a requirement. Apparently this page is not for the Pontem airdrop itself but a future project we don’t have details on yet.

Additional protocols.

Mint some amAPT liquid staked Aptos using Amnis Finance. You can also mint and stake StAPT.

Lend your liquid staked APT using Aries Markets. You can borrow APT and loop this or use borrowed tokens as LP on Liquidswap.

Make a few swaps on Thala

There are currently only around 100k active APTOS wallets. If the next airdrop is 5% of a 4b MC coin, that could amount to $1500+ per qualifying wallet, depending on allocation criteria. If that happens Season 3 will be heavily diluted and our edge will be gone.

2/ Reya Network

Given recent performance, it shouldn’t be surprising that any opportunity that requires liquidity in any form has become an auto fade for the majority of farmers. We can use this to our advantage by taking a small position while others lick their wounds on the sidelines.

Deposits to Reya are in USDC. If we think about Reya as providing yield on stable coins, 16-35% is a typical yield depending on your risk appetite. I think there is a decent chance we can at least hit the upper end on that with Reya tokens, with upside for more. As with anything new, consider the smart contract risk vs potential reward.

Reya raised 16M from Framework, Coinbase, Robot Ventures, Amber, Wintermute, Bankless, and others. I suspect if zkSync or other L2s perform well in the face of so many recent dud airdrops, we could see a late scramble to provide liquidity on Reya.

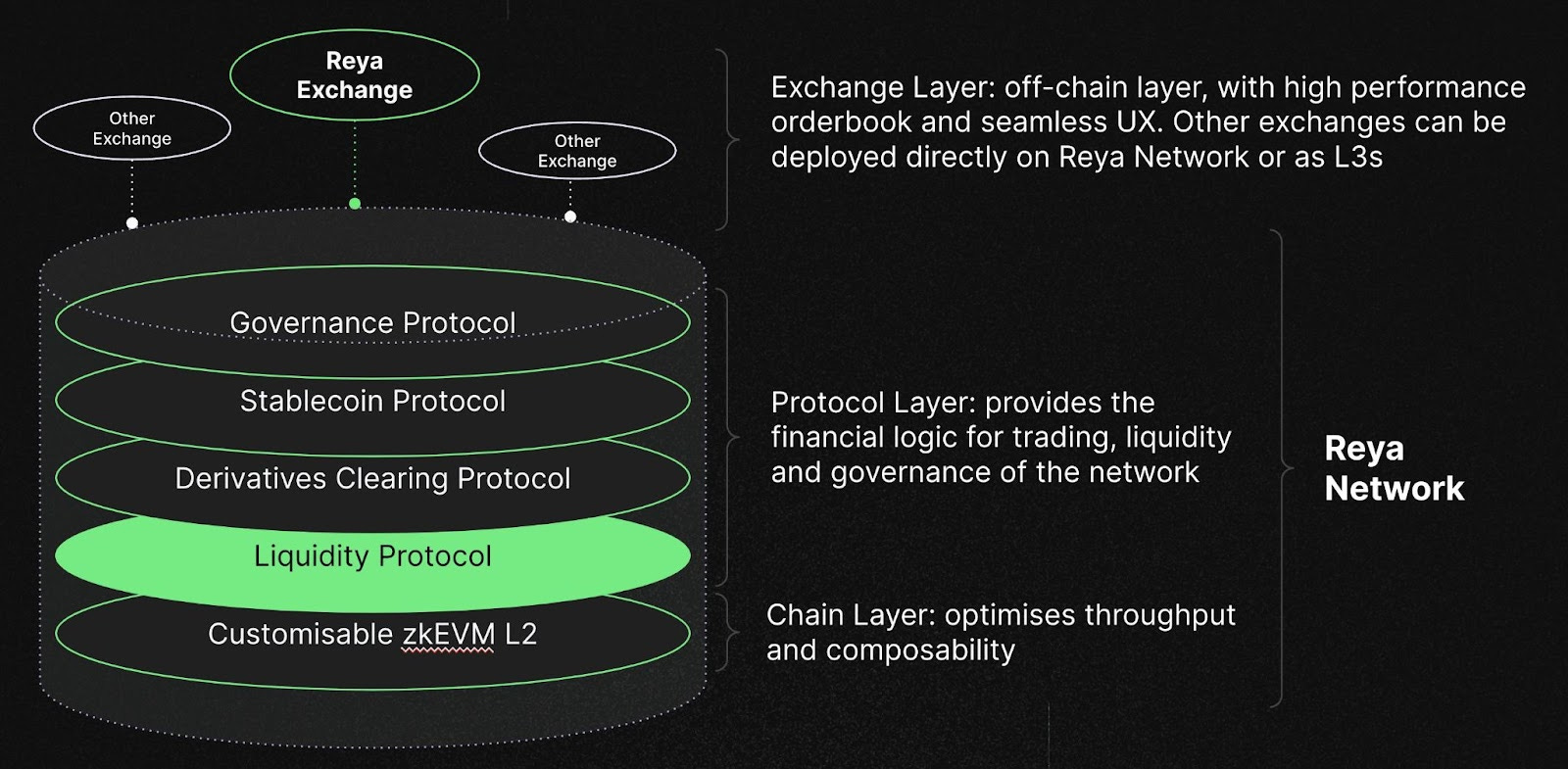

Reya is built on the Arbitrum Orbit stack and capable of up to 30k tps. Reya aims to build a trading optimized modular L2. Focusing on infrastructure for DeFi, and a passive-LP Pool. The passive LP leverages price index generation to facilitate contracts at an index. In theory this reduces execution risk for traders. DeFi focused chains aren’t particularly sexy but given the star studded backing, Reya has a chance to outperform.

USDC can be deposited from ETH mainnet, Polygon, Optimism or Arbitrum. Even better, withdrawals are already enabled (if a bit convoluted until it becomes a one click option).

This means you don’t necessarily have to deposit USDC for months on end. You can zap in for a few weeks and if you need the capital, withdraw it back without ever interacting with ETH mainnet.

The EXP boost is active until May 13th so this is time sensitive.

There is currently $90mil deposited in 45k bridges giving an average of $2000 per depositor. It shouldn’t require a huge amount of capital to rank up with Reya. One day, one of these “deposit to earn” projects will not be totally linear and a minimum allocation will make faders weep.

3/ Sanctum

Sanctum is more of a bonus play in that if you are holding Solana in any form, I think it is worth the small amount of effort and smart contract risk to farm Sanctum passively and apply several compund strategies.

Sanctum has quickly garnered adoption growing from $35mil to $500mil TVL in the last 6 weeks.

Sanctum raised over $6 million from Solana Ventures, Dragonfly capital and Sequoia capital.

Currently the median deposit is less than 1 $INF. Holding 5+ INF will put you in the top 20% of stakers. If the TGE is not entirely linear there is a chance for a more than reasonable allocation. If the token is issued solely based on capital deposit and you were holding $SOL, well you haven’t really lost anything and likely outperformed other staking strategies.

If you are completely new to Sanctum, the platform is a gamified liquid staking one stop shop.

Stake/Unstake and Swap between LSTs easily. Sanctum aims to increase decentralization by reducing the concentration of LSTs with large validators.

Deposit a variety of Solana LSTs into the infinity pool to receive $INF the native LST of Sanctum. $INF is a yield bearing token that provides yields from fees on the platform and the yields of the deposited LSTs.

Sanctum currently supports 18 different LSTs. Holding a minimum of 0.1 $SOL of any of these LSTs in your wallet creates a pokemon style “pet”. Pets gain EXP every minute corresponding to the amount of the LST held. Each pet earns 10 exp per 1 sol worth of LST per minute. Each pet can “evolve” up to 3 times based on experience level and can reach a maximum level of 999.

Once you hold an LST click on the EXP counter at the top of the screen to see which pets you own and how close you are to leveling up.

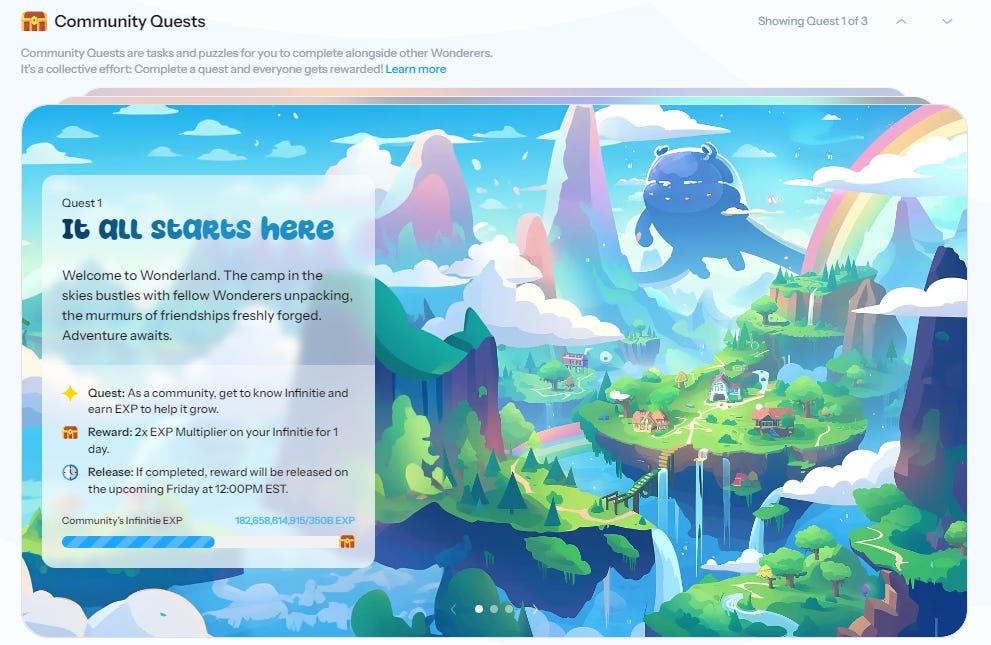

Sanctum offers “Wonderland” community based quests throughout the season. Completing the wonderland quests will earn EXP multipliers for your pets.

Sanctum Strategies

If you want to “collect them all” consider holding a minimum of 0.1 of all 18 LSTs there could be a bonus multiplier for have each “pet” above a certain relatively low level.

Which LSTs to buy and hold and why? I've gone through all of the available LSTs and I'm going with these 5 for the following reasons:

Keep reading with a 7-day free trial

Subscribe to Insightful Insiders to keep reading this post and get 7 days of free access to the full post archives.