The BTC airdrops you should NOT farm (and why)

Identifying what to fade is arguably more valuable then trying to dig for "gem"

Almost if not more important than digging for airdrop “gems” to farm is to filter out all of the things that are worth ignoring/ finding in order to not waste you time or capital.

Perfect example of this semi recently was the Orderly airdrop.

When they announced the Epoch part of their campaign I instantly stopped interacting with.

After factoring in the fees paid on Perp DEXs + not even including the fact that most of the trades your going to take are going to be in a loss (even if they are only open for 5 minutes when trying to farm volume) I decided that it was going to be -EV (expected value/ lose more money than the amount of money and time you put into it) to keep interacting with campaign until snapshot TGE.

And it turns out I was right, I had a similar approach to Debridge, which I only used naturally across my wallets when moving funds between EVM and SOL while tying all of those wallets to the main / anchor referral account, so I could “passively” get points for interactions I was going to do anyway without intentionally or aggressively farming it.

Debridge turned out to be basically break even or a slight profit or loss for most people.

I also did the same thing for Linea, once Linea park rollout I started to try and work through the campaigns but it was so tedious, grueling, uninspired, unenjoyable, and buggy I decided that I’m going to completely fade anything else that Linea comes out with in the future.

Also doesn’t help that they have been farming users and launch interaction campaign for over a 1.5 years at this point

https://x.com/info_insightful/status/1776357384039944256

My only exposure to Linea is in the form of Mitosis, as the Scroll TGE recently happened I migrated what was in Mitosis on Scroll over to Linea, I’m mainly doing this just to farm Mitosis and not really Linea in itself.

Despite this I think its important to highlight L’s/ losses. The big one recently being Scroll, which I admittedly spent too much time and capital on relative to other options that would of been much more productive and +EV.

TLDR - Scroll was basically one of the worst airdrop distributions/ campaigns done in existence for a variety of reasons, some of which include

being purely linear with no upper cap thus the top 1% of addresses by TVL gained 60% of the total airdrop supply, this was the biggest issue imo resulting in the remaining 99% of users getting an underwhelming allocation https://x.com/Andrey_10gwei/status/1848441529737634271

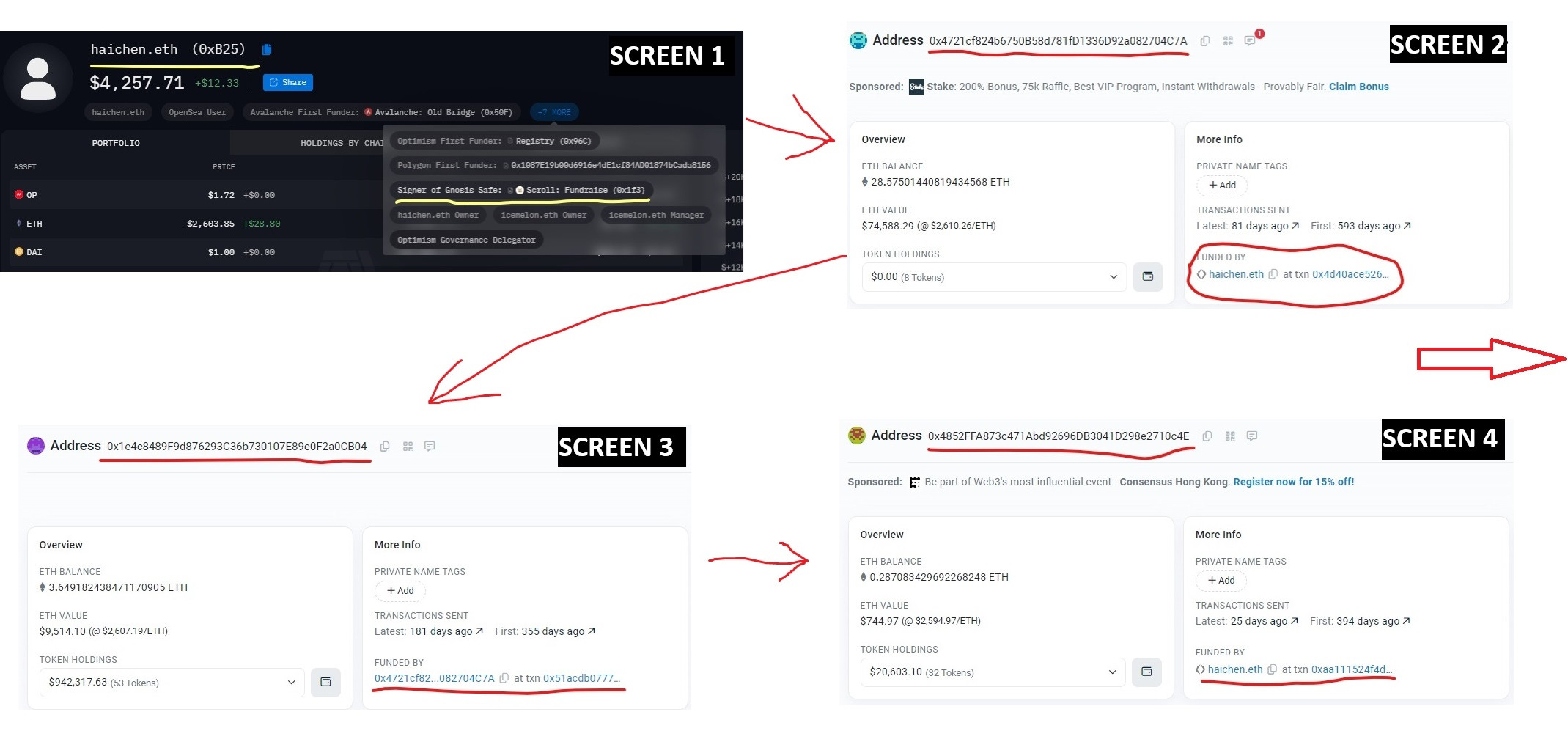

Team and fund wallets were able to farm the token despite the scroll team saying that they wouldn’t allow this

Essentially no distinction or extra rewards for being a early user, minting NFTs, interacting with different protocols ect

only 5.5% of the supply (after subtracting dev and contributor allocation from core airdrop) which was the same % amount that the Binance launchpool was given allowing whales to depsoit and farm BNB bsacially earning more in 2 weeks than mose users would earn over 2 years

snapshot was announced a head of time

Team basically didn’t give a single fuck about feedback from users around this despite saying otherwise. Actions > Words

basically 2 years of farming and milking campaigns since the testnet went live = large capital and opportunity cost

Despite all of this the red flags were there early on and throughout which included

Launching a social farming Galxe campaign (despite this being very overused and ineffective at the point in the cycle where they rolled it out) they quickly shut down the campaign after negative backlash

Soon then launch the Scroll marks campaign which was basically a lazy campaign where only amount of TVL + time mattered

When the marks campaign rolled out many of the Marks for interaction with Core Dapps on Scroll were not even being calculated correctly for a long time (Ambient), or it just took forever for any DApp in general to get integrated and many just were never added into the Marks dashboard page at all

So with all of that being said lets go over all of the BTC related airdrop opportunities that I’m fading and the reason for doing so

Easy/Hard Fade Category

Coinbase (cbBTC): Coinbase (cbBTC): I'm opting out for now due to 0xngmi's concerns about transparency, and I doubt a Base airdrop is imminent.

I prefer to invest in more promising opportunities like fBTC, uniBTC, solvBTC, lBTC ect (mentioned these already in previous premium posts).

However, if you're interested, you can use Contango to open a leveraged position in the cbBTC and WBTC pool, potentially yielding over 100% APY on Zerolend.

Swell (swBTC): Easy fade, lost interest in getting farmed by Swell a long time ago and think there are better places to put funds, doesn’t help that they delayed their TGE for over a year and S1 users basically got dust.

pStake: another liquid staking token (LST) protocol. While they have a token, it's not their main focus. They've raised $10M in funding, but the token's fully diluted valuation is only ~$20M.

Coredao: funding details remain somewhat unclear, yet they've achieved considerable success/PMF but that isn’t really helpful or appealing for us. Their token is already live, with Season 2 underway. Despite this progress, they distributed 25% of the token supply in the initial airdrop and have not allocated more for users.

Unirouter (uBTC) is a BTC LST protocol that issues uBTC, which can be used in various 2-in-1 and 3-in-1 configurations on B^2. I’m not a fan of B^2 chain (lack attention, mindshare, project integrations, funding, liquidity, and incentives) to be worth it thus I'm steering away from it.

There are some more I want to put into this category but in order to keep this entire post relatively digestible while also be able to cover the next category were going to end this section here and round everything off in BTC ecosystem in the next and final BTC eco airdrop edition.

The “Meh” might be worth to put a little in here if you have more/excess capital category

Keep reading with a 7-day free trial

Subscribe to Insightful Insiders to keep reading this post and get 7 days of free access to the full post archives.