The Bull Case For TON - Where To Look In The Ecosystem

TON = Apple iOS, Every other Chain = Blackberry

The gaming ecosystem on TON is continuing to grow

I have previously covered the TON eco in this post

A summary of that post:

TON vs. Competitors

TON is like Apple iOS, while other blockchains resemble Blackberry.

Key Advantages:

Core App Growth

Telegram's user base grows 40% annually, with 180M daily active users and 800M monthly active users.

Network Statistics

4th largest L1 by market cap ($20B), behind ETH, BNB, and SOL.

4th highest daily active users (480,000).

3rd highest average daily revenue ($40K).

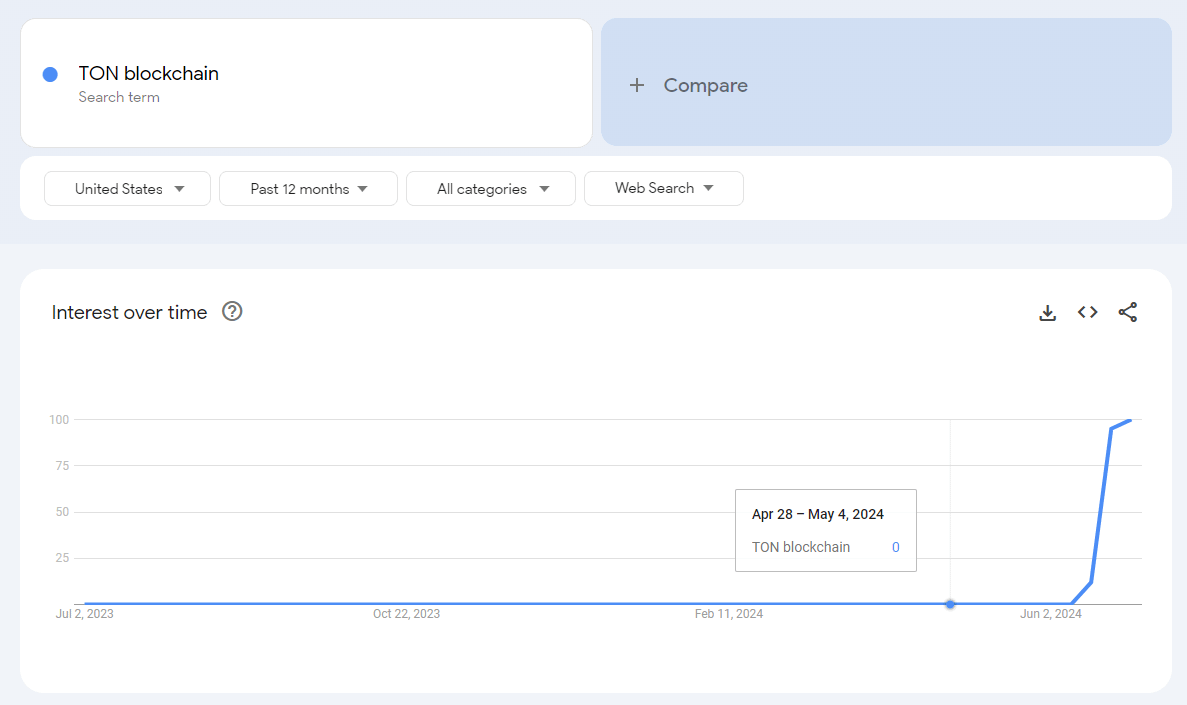

Best performing L1 YTD with 221% growth.

Initial App/Games Traction

thenotcoin: $2B market cap from "tap-to-earn" games.

hamster_kombat: 116M users in 72 days.

CatizenAI: 15M users in 60 days.

Parallels to Early App Store

As outlined in a substack article by Peter Carroll - founder of GrowStudioHQ and PlayPushGo (a subway surfers type game coming to TON) There are a lot of parallels to the TON app ecosystem today and the early days of the Apple App store

Like Apple, Telegram provides a centralized platform, empowering developers and offering convenience to consumers.

Integrated Monetization Models

In-app purchases, ad revenue sharing, wallet/trading bots, high revenue share for creators, and USDT payments.

Opportunities for Founders and Builders

Access to Telegram’s user base, seamless financial integration, and network effects boosting growth.

Future Prospects

While current "tap-to-earn" games lack depth, the potential for a breakout user application in the TON ecosystem is high, similar to the early days of the Apple App Store.

So What Do I Do Now ?

Since you are not going to make massive gains at this point just buying $TON as its already at ~$15B MC and ~$31B FDV, so the beta to this is to find new applications (that ideally will have a future airdrop for their users) and potentially degen into some memecoins

Assuming you have already set up your TON wallet within telegram good place to start is also the apps page on tonscan that listing a multitude of

Tonstat can also be used to see the overall on-cahin metrics of the TON ecosystem

A project mentioned earlier PlayPushGo is a project on my watch list, public access should be live in the next 1-2 months and they are launching a play-to-airdrop campaign. The reason this is more interesting to me is the previous game meta we have seen on TON is just tap-to-earn games. These are very unengaging and very abusable by bots

Since plank Pushers is basically a subway surfers variation and the obstacles are randomly generated, this type of game should be much harder for bots to sybil in comparison to tap games, making your potential earnings from participation much less diluted.

Another project elympics_ai recently launch their S1 campaign of Gamecamp, an initiative to build Web3 games on Telegram back by an official grant & marketing support from the ton_blockchain

https://x.com/elympics_ai/status/1819356923226910740…

People farming points/respect will be able to get rewards before TGE There will be a total of 6 seasons each last 1 week (Fri-Fri)

https://x.com/ton_blockchain/status/1813592387236823102…)

Participation is free, create an account, connect your wallet and socials, play games and complete quests to earn points/respect.

You can get a permanent boost to your points/respect earnings using my link HERE

Transparency disclaimer: Content around Elympics in this newsletter post and on my twitter over the next month is sponsored by Elympics.

regardless of this, if you have some extra time to set up your account and accumulate quest rewards throughout their 6 weeks campaigns the potential rewards are unlikely to be diluted as these interactions are not easy to sybil and being on TON means it more likely to go under the radar of the majority of farmers.

What’s going on in the trenches?

In terms of memecoins we can check Dexscreener and filter to only show TON coins for the coins that have the highest marketcap and mindshare.

Ignoring Notcoin (since mc is too high already at ~$1.2B)

If we filter by top volume we can see that most of the liquidity is going through $REDO, $DUREV, and $TCAT, do with that what you will and degen responsibly