The Framework For Farming Only The Best Airdrops - Part 1/2

How to filter out the noise and avoid getting farmed

Many have expressed interest privately about wanting access to a premium discord, before potentially launching it, I want to gauge interest via this Google Form here that should only take you ~2 minutes to fill out:

“A guaranteed airdrop of $10k+ that will only take your 10 minutes and 20$ to qualify; this is how, you would be stupid not to farm this.”

Sound familiar? Often, these are the clickbait hooks you see in various Twitter content to maximize attention and engagement. You read the hook and think there is a real opportunity.

After months of farming and hundreds of dollars in fees, you receive nothing.

This happening 1 time is one too many, which is why creating your own airdrop vetting system is crucial to saving your time, capital, and sanity.

This is the framework that I use to filter out the noise, so I’m only targeting the highest potential opportunities. While not every element of this framework is applicable for every potential tokenless project, you can use it as a solid baseline to learn how to locate the next major airdrop on your own.

1: Scouting out potential candidates

1.1 The Crypto IDO/ICO page is one place to start. Some filtering needs to be added to reduce your search time Here are a few options:

filter by the “Tier 1 VC” label

Look at the investment history of high-quality VCs that have invested in projects that have done lucrative airdrops like Jump Crypto (Wormhole and Aptos) or Paradigm (Blur and Friendtech)

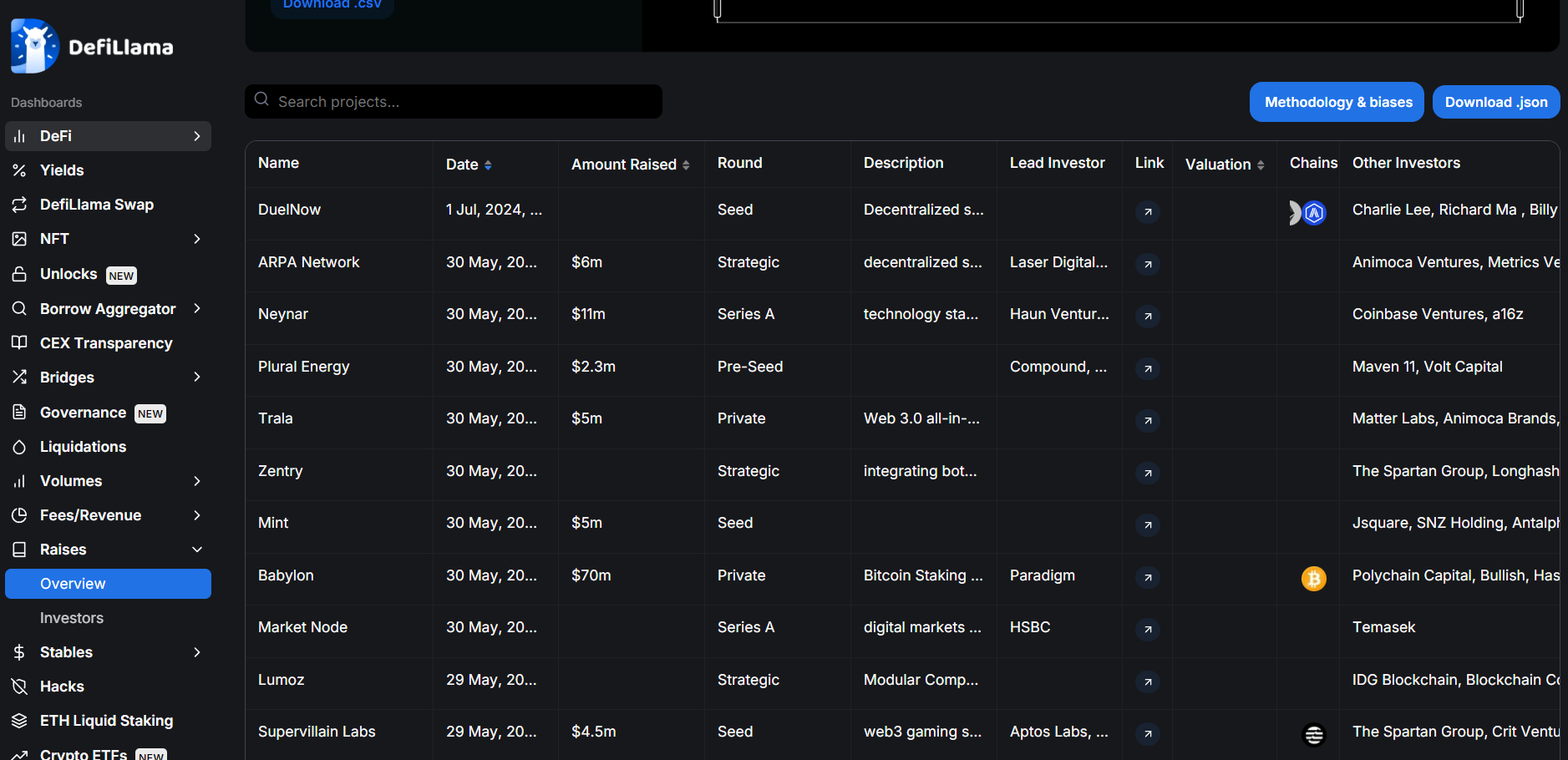

1.2: Defillama has an airdrop/tokenless protocols page that lets you apply various filters, such as chain type and TVL range

An even higher signal than this page is the “Raises” tab on Defillama

1.3 Another option is to create your own twitter list from scratch, use someone else’s as a template, or just follow their list.

Here is a list I made that has over 120 projects in it; this list gets updated and filtered every few months: https://twitter.com/i/lists/1721211708675657849

Quality checklist

TVL size: You want to find project that have established some form of traction and market interest. The projects you are looking at should ideally be in the top 25% of projects in its ecosystem, chain, or niche and have at least $500k-1M+ in TVL.

Funding/raise size: Generally, if a project has under $4 million in funding, it usually fades, unless it is very niche and did not require a large upfront investment. The amount raised is generally proportional to how much value the airdrop will be worth when distributed. Larger funding also usually comes with more attention and mindshare, thus diluting your potential amount and value, so there is a balance in this.

Narrative and Ecosystem: does the tokenless protocol fall within a new and exciting ecosystem or narrative (RWA, AI, Modularity, Interoperability, Gaming, SOL, Base, ect). Would this project appeal to institutional players or normies? Are there any strong catalysts or narratives that would make people want to buy the token after TGE?

2/ Less acknowledgment of potential airdrop = more bullish

It's hardly a given that you will always be early. Make sure the project is not aggressively using its airdrop for marketing by checking its social media accounts.

The key is stealth. For legal reasons and to avoid Sybil and mercenary capital projects, they should actually not be trying to advertise a future airdrop. A large majority of projects will naturally have a token at some point.

This not only allows the team and investors to start realizing gains, but the opportunity cost of not dropping a token is very high. If they do not have a TGE in this cycle, then they are going to have to wait another whole 3+ years until the next cycle to cash out a decent valuation.

Quality checklist

Never announces or acknowledges there will or could be an airdrop in the future = bullish

Not being heavily covered on heavily viewed “late sources” such as Youtube, Dapp Radar, Airdrops.io, ect

Subtle hints: loyalty programs, hidden or subtle points systems not advertised on the projects socials

Does NOT aggressively advertise the airdrop for marketing. If they are reminding you every 1-2 weeks, there is eventually going to be an airdrop, this is bearish (Hello Orbiter FInance)

3/ Dilution

This is a major factor in all farming. Depending on how the project conducts itself, your potential airdrop rewards (especially in these points systems) can be heavily diluted at any time.

In a nanosecond, larger players can propel you from rank 500 to 50,000.

Eg: Kamino announcing a snapshot date 2 weeks before it was going to occur allowed a ton of whales, funds, and mercenary capital to pile in at the last minute to gobble up a large share of the points. Minnows and dolphins who had deposited for months were eaten alive.

It is safe to say a majority of the users were not happy, and the token price isn’t exactly setting the world on fire.

Quality checklist

Farming window: how far in the future do you expect the snapshot date to be? Ideally, it should be no longer than 3–4 months. Is the project trying to milk you for 6+ months, Do they keep delaying their TGE and adding more points seasons?

Eligibility Threshold: How long and how much capital will it take you to reach the top 20–25% of all competing wallets? Historically, this is the “quality” or “ranking” threshold you want to try and reach to be eligible. Being able to rank within this level with $500-$1k in capital in ~30 days is a good general baseline of the maximum “effort” you want to find.

An example of this is in this post here where I evaluate a variety of the largest tokenless L2s using Dune dashboards to compare “wallet competition.”

Sybil protection: What mechanics or filtering criteria is the project using to reduce the amount of rewards potentially going to Sybils or low-quality users. Are there reward mechanisms that are hard for Sybil farms to “game” (Eg. time-weighted LPing, proof-of-humanity mechanisms, etc)

Project Consistency: If a project has a history of constantly changing its criteria, timelines, points system or delaying its TGE or snapshot date, this is bearish.

We’re going to end Part 1 there. In the future, I want to try and make these posts more bite-sized but increase the frequency of the posts so they are more absorbable for the majority of people. Stay tuned for part 2 in the coming week

This content was heavily inspired by a great post by Deebs_Defi, I recommend you go check out his twitter account.

If you would like to support this free content, consider upgrading to a paid subscription.

In recent Insightful Insider newsletters, we have covered

Ranking up to the top 2000 wallets in an omnichain DeFi platform backed by some of the smartest money in crypto with $200

An optimized interoperability bridging route that incorporates 12 interactions with 10 tokenless protocols for $6

The subscription also includes:

Access to all future Subscriber-only posts and full archive of all past premium posts

Access to more "Underfarmed" airdrop content that I believe is being overlooked by the majority and don’t want to post publicly to avoid dilution

Occasional extra-free detailed guides and resources that include spreadsheet interaction trackers with word documents that detail the thought and research process to show how to efficiently farm with example routes

All of this for only $11/month