Your underexposed to BTC airdrops: This is why and how you can position

New wallet + new chain friction = edge

Preface

Airdrop farming landscape in BTC eco feels eerily similar to SOL before Jupiter + Jito dropped

Primarily due to a combination of 2 factors:

New wallet + new chain friction = edge

"What I have to download ANOTHER wallet from unisat_wallet or XverseApp or MagicEden, I'm good ill pass"

" What I have to download another wallet for SOL (phantom, Backpack, ect), ill just send my Funds to a CEX and withdraw to SOL"

"What I have to learn the difference between a Segwit and Taproot address so I don't (potentially) lose my coins or NFTs, that sounds too scary I'll stay here in cozy EVM land"

"What I have to deal with Wormholes terrible UI to interact with it (assuming you didn't know about MayanFinance, or Allbridge_io), I'll just use DeBridge instead

And we all know how Wormhole played out (printing thousands of dollar per wallet for only doing a few bridging interactions from EVM to SOL with decent $1k+ volume)

As a side note BTC has historically outperformed most alts and majors (ETH) and currently feels more "stable" than ETH liquidity farms right now (instead of holding ETH to farm tokenless projects you’re holding BTC instead).

I suspect a majority of farmers right now are more overweight ETH than they would like to be and once all the Eigen + LST and restaking compound farms on top of it play out (by the end of this year?) then people are going to be wondering why they are still holding ETH.

Types of BTC farms

To boil it down and make it simple basically all the BTC related farm fall into about 3 main general categories:

1/ Some type of compound/restaking play on top of Babylon infra ($96M funding, basically the “Eigenlayer of BTC”)

Examples: SolvProtocol, Bedrock_DeFi, FBTC_official, Lombard_Finance, satlayer

2/ Some type of EVM compatible “BTC L2”

Examples: build_on_bob, use_corn, and BitlayerLabs

3/ Miscellaneous/ ones that don’t quite fit into any of these categories

Ex. Liquidium (before they had their TGE), using the Unisat wallet, Mezo + Acre (compound play on top of Mezos)

So the sweet spot/ my general strategy is a combination of the following:

- have diversified exposure across all the Babylon compound plays (at least something in all of the main ones with minimum $5M+ funding)

The way I see the Babylon compound farming playing out is that one will out perform while all the others + anything that’s Seasons 2 or later will underperform

Similar to how for Eigen ETH LSt plays Etherfi S1 outperformed but every other LST play and future seasons of Etherfi underperformed

It seems like chad farmer CC2 also tends to agree

- similar strategy across BTC EVM compatible farms (at a lower weighting compared the Babylon compund plays)

- try to find "gems" of projects that are BTC native but NOT a Babylon compound play (Ex. Liquidium if you took the heavier sybil route, or Acre as its overlooked and underfarmed imo nad I’ll explain later why)

Due to there being so many different BTC and in attempts to make each of these posts not painfully long this topic will likely spread across 1-3 total posts with this being the first one.

With that being said lets jump into it

1/ Mezo + Acre

Mezo - $28.5M funding and under 20,000 wallets

For Mezos you can either deposit funds directly from BTC mainnet or from one of the supported assets on a supported EVM chain.

To gain access for the time being you will have to use a code, you can use any of the following links here, if they are all used up DM me on twitter and I’ll hook you up with more codes (they only give you 4 codes per wallet/account)

BJFTY

PLOMC

SADGA

CF85H

0XMO6

In terms of what assets to deposit I like Thresholds tBTC as the same firm owns both Threshold and Mezo so there may be additional benefits to those users that naturally use both products

If you have BTC on EVM use a bridge aggregator like RocketX to bridge to Bitcoin mainnet

You can mint tBTC on their official dashboard here:

https://dashboard.threshold.network/tBTC/mint

Once you have decided what asset you want to deposit, select a desired lock-up period, longer lockup = higher multiplier for your points.

My overall take - one of the better Bitcoin L2s plays due to strong funding, minimum deposit of 0.01 BTC (which helps against dilution), and the connection to tBTC.

After some testing and feedback from other you can reach rank ~12,000 after having deposited 0.15 tBTC in 2 days (assuming you picked the longest 9 month lockup for the highest multiplier)

This is not the only way to farm Mezo. You can deposit BTC directly from BTC mainnet or deposit other LSTs/tokens across BTC or EVM.

Acre - Why this project is arguably the #1 most underfarmed project in BTC airdrop land

Context

Acre provides the liquidity needed to scale Bitcoin. Users can deposit BTC and receive stBTC, representing their deposited BTC.

This BTC is then allocated to Bitcoin layers that use BTC as their Proof-of-Stake asset, earning rewards for stBTC holders.

So why is this "underfarmed"

Because going through the docs is boring but can sometimes be worth the asymmetrical info found

Now while its unlikely (and prolly shouldn't) all happen at once, will likely be over multiple seasons and could be rebranded/renamed as incentives

min amount needed 0.015BTC + high 0.001BTC ($50-$60) deposit fee = higher capital commitment (thus less likely to be mas sybilled)

(Semi) Non-visible points system

Earn Acre Points: Your BTC balance is regularly tracked, and points stack up based on the amount and how long it’s deposited.

Bonus Points: Score extra points through programs linked with Acre.

Double Up: Deposit BTC into Acre and rack up both Acre and Mezo points

You can get started here: https://stake.acre.fi/

Lombard + Corn (within Pendle)

Lombard

Pendle Strategy Route

https://app.pendle.finance/trade/points/0xcae62858db831272a03768f5844cbe1b40bb381f?chain=ethereum

There are a few options you can take here

1/ YT LBTC (Corn) - “Leverage your points exposure at a cost by buying YT. On top of YT's leverage, you get additional bonus multiplier from Lombard (Corn).

YT will have 0 value at maturity. You can exit anytime at its current market price while retaining all the points earned up to that point.”

Babylon leverage 62x points, Corn and Lombard 185x points

We can see in the top left that the maturity date is Dec 25th 2024

In the YT strategy you are essentially burning money in order to turbo leverage farm the amount of points earn relative to the amount of capital provided

2/ LP LBTC (Corn) - “Retain most points from LBTC (Corn) while earning LBTC (Corn) yields, $PENDLE incentives and swap fees.”

In this version, you are retaining most of your points from your funds deposited, you earn points at a much lower rate but your assets are not worth 0 at the maturity date (from my understanding)

3/ PT LBTC (Corn) - “Forego your LBTC (Corn) yields and points for fixed yields. Each PT will be equal to 1 LBTC on Corn at maturity”.

This version = you get no points but in return you get a fixed guaranteed APR, imo this isnt worth doing as a ~7% APR with no points earning is not appealing to me at all.

My strategy - a combination of the YT and LP, the weighting of it is up to you (50%-50%, 25%-75% ect). YT inherently has much more risk with it if the airdrop ends up being underwhelming, for example if you went the YT path with Etherfi S2-S3 you would of lost money or broke even if you were lucky.

The alternative of course is to just deposit into Lombard or Corn directly (no pendle leverage)

Lomard - https://www.lombard.finance/app/stake/

You can either:

1/ mint LBTC by sending in BTC from BTC mainnet and then it will be minted to the EVM address you tie to it

2/ Use the swap feature directly on the site to swap various assets into LBTC

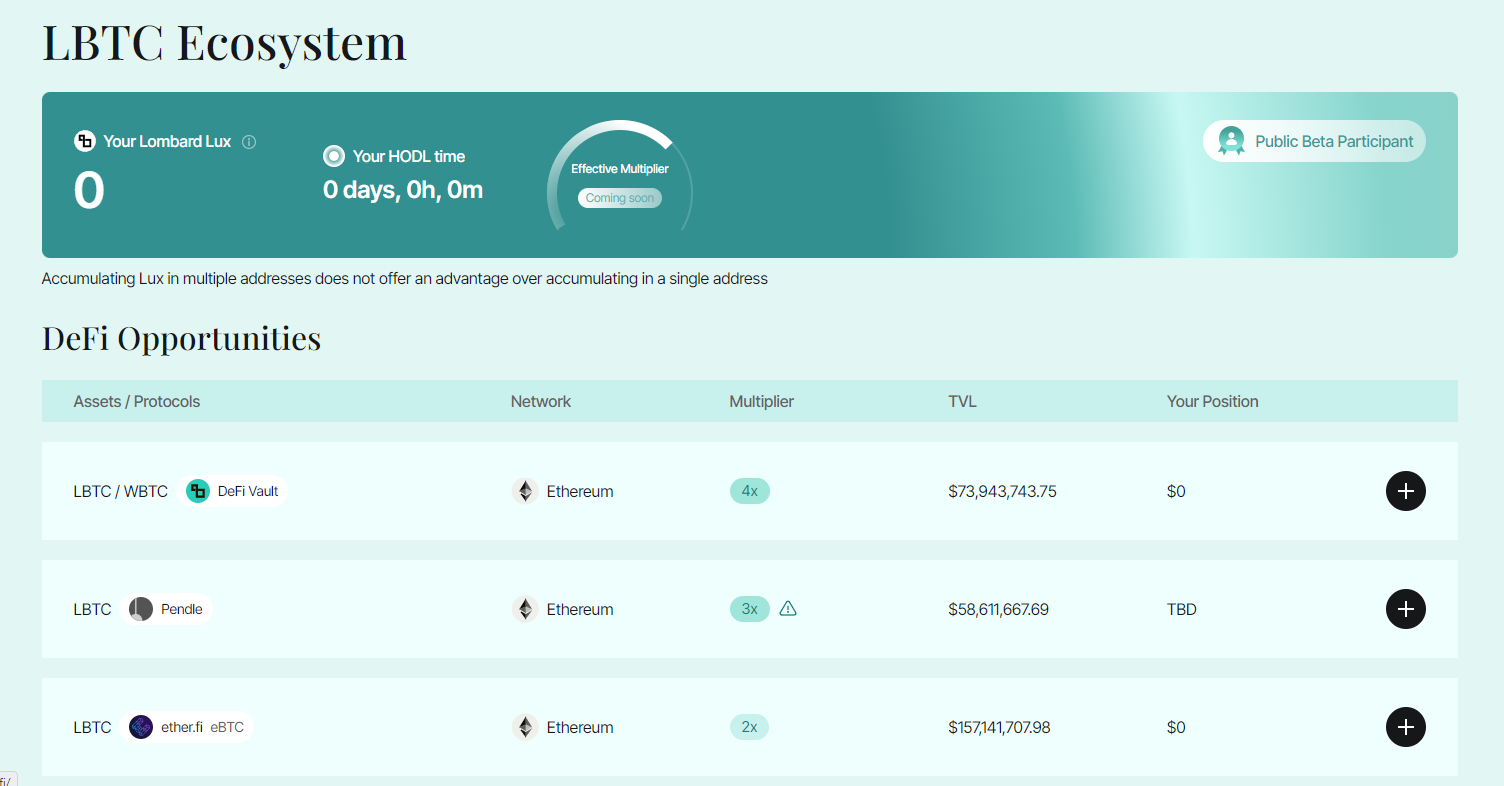

for deposit options there are multiple, but you will earn the highest multiplier (4x) by depositing into the Lombards native defi vault

Corn

Ironically we can see that the highest multipliers are given for the strategies on Pendle mentioned earlier. Since depositing directly on Corn or Pendle requires you to be on ETH mainnet imo it’s probably +EV in my mind to being primarily in the LP pools on Pendle, with some side exposure in the WBTC and LBTC pool directly on corn on your main account just so that you have a presence there.

You can get early access to Corn by using any of these invite codes

https://usecorn.com/app?code=ax58-6mmx

https://usecorn.com/app?code=dmym-ed6g

https://usecorn.com/app?code=8d88-pep9

https://usecorn.com/app?code=38fy-9dy6

https://usecorn.com/app?code=fryp-6xbk

https://usecorn.com/app?code=emx9-rhfm

https://usecorn.com/app?code=4gpe-8rmb

https://usecorn.com/app?code=xpkj-gbcf

https://usecorn.com/app?code=75jb-nchg

https://usecorn.com/app?code=kyac-jggg

3/ Unisat Wallet

unisat_wallet currently is the most +EV wallet to use for BTC from what we have seen historically

Unisat users got airdropped $500+ of $PIZZA and $400+ of fractal_bitcoin just for using it

Here is a short points guide on how you can maximize to position yourself for another potential airdrop:

Quick Context

Raised undisclosed amount from from Binance Labs, OKX Ventures

Unisat launched a points system long time ago but is generally underfarmed as BTC beta eco (runes, ordinals, BRC20s are "dead" compared to when they giga peaked around the recent halving)

Points Guide

Each transaction accrues 1 point (do when gas is low ~$1 or less)

Minting BRC tokens and Runes will also get you 1-3 points depending on how much you inscribe/mint

I would do these when BTC gas is low (usually in the late evenings EST time or on weekends, just like gas for ETH)

I have no data to back this up but based on how niche and somewhat difficult it is to find the points page, I’m going to guess that you can rank in the top ~30% of all users with 25+ points

https://unisat.io/address/points

Going deeper within Fractal

fractal_bitcoin is a Layer2 Network on BTC, developed by unisat_wallet.

Mainnet was launch recently on Sept 9th

You can bridge funds over using the bool_official bridge ($2M in funding tokenless)

In terms of what to do one fractal you can try and play the new token launch on the Fractal chain to do some quick flips some examples of past launches that did well were $ CAT (5x), $ FLUX (32x), and DomoDucks went from 6 - 44 $ FB

You’ll need $ FB on your wallet for gas you can do this by swapping your Bitcoin from the taproot network on your Unisat to the Fractal Bitcoin network on your wallet.

You can do this by depositing Bitcoin to your normal unisat Bitcoin taproot wallet then go to http://dotswap.app, deposit Bitcoin from your Bitcoin network to your Dotswap account, go to swap section on Dotswap and Swap the Bitcoin on your dotswap account to FB token, then withdraw it back to your Fractal Bitcoin wallet on unisat.

The bull case here is each mints and inscriptions you make adds to your Unisat points on Fractal Bitcoin in theory increasing your chances of getting airdrop from new projects launching on them.

Personally, I’m going to pass on this as imo it requires too much time and effort to make a lot of money (you would have to stalk and hit new mints/inscriptions with at least 5-10 wallet to make it worth your time imo).