The Framework For Only Farming The Best Airdrops - Part 2/2

To farm or not to farm - that is the question

This is part 2 of my framework series. In order to have all of the information and context, I recommend you spend 5 minutes reading through part 1 previously covered HERE

4/ Opportunity Cost

In a bull market that generally trends up, time, capital, and opportunity cost are significantly more important than they are in a bear market.

Your money AND your time are precious. It is crucial to preserve these assets, protecting them from a project that has a poor valuation, a protracted lockup period, a questionable team, or tokenomics driven by greed.

Being selective, only picking projects with the greatest potential, and managing your time commitment is crucial to avoiding pain in the future.

Quality Checklist

Time Efficiency: Can you farm this without spending a large amount of non-productive time?

Can you apply an “LP and chill” approach where you “set and forget” the capital and farming strategy without requiring continuous monitoring and maintenance? Remember that many LP farms still require active management to avoid falling out of range.

Can you apply "compound,” or “lego” strategies where you can farm multiple airdrops simultaneously?

Examples:

4.1/ Scroll Ecosystem

LPing WrsETH/ETH on Ambient Finance on Scroll allows you to earn Ambient points, Scroll Marks (points), Eigenlayer points and Kelp miles.

4.2/ Mantle Ecosystem plays (campaign recently started and ends in ~3 months, you earn powder for using mETH in defi DApps on Mantle which will later be converted into the $ COOK governance token)

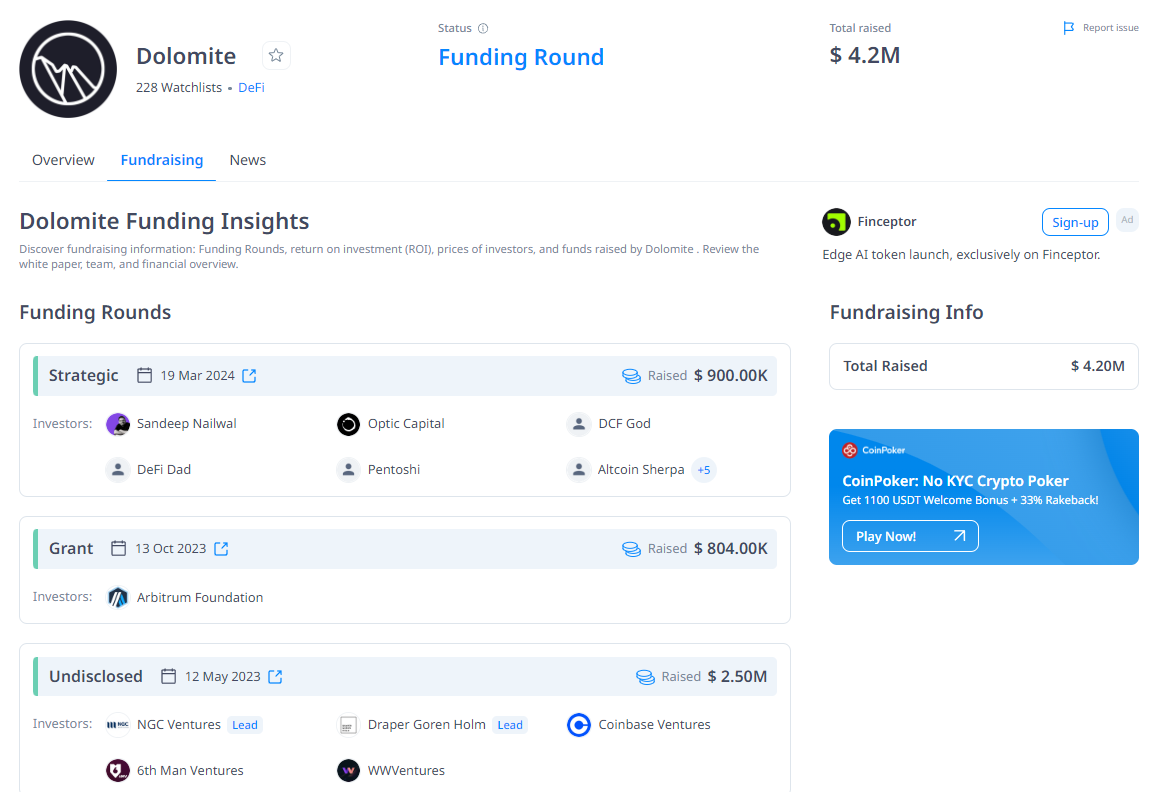

Lending and borrowing mETH and WETH on Dolomite allows you to farm Dolomite minerals (points), mETH powder and Eigenlayer points.

Doing a similar strategy on INIT using their liquidity hook (built in looping feature) lets you earn powder, INIT points and Eigenlayer points.

Depositing mETH into Karak allows you to farm 2x Karak points and 20x mETH power (karak codes: TELKb PKROn znFb0 Jykdy gYWab knigP 1iltl ) Note: KArak has a 7 day unlock period.

LPing your mETH in the mETH/USDT pool on Merchant Moe (or other DEXs) grants the most amount of powder/USD$ amount but you are forfeiting the upside to ETH since half your position is in stablecoins

This also requires more active management to make sure your LP is within range. You can have a max range of +- 20% of the current price and still be eligible to earn powder, which is pretty lenient and wont require you to readjust your LP very frequently. LPing earns 40x points but only applies to half of your position so I prefer Karak.

You can use this link to get a permanent 10% boost to your powder earnings and track your progress (make sure you scroll to the bottom and “bind” the code to your wallet/account)

4.3/ Mitosis

Depositing weETH (wrapped eth from Etherfi) on Linea or Scroll on Mitosis lets you earn Scroll marks/Linea XP + Mitosis points + Etherfi points and Eigenlayer points

5/ Upside Potential: Does the project you are farming have a higher estimated FDV/MC than other comparable tokenless projects within its niche?

How many users are you competing with?

How much of the total token supply percentage will be airdropped to its users?

As a baseline, I like to see at least $4M-7M + in funding. The hope is that the team allocates at least 6-10% of the airdrop at TGE.

As mentioned in Part 1 you can use sites like Cryptorank to search for and compare project valuations to previous raises

6/ Liquidity restrictions

Are you forced to lock your capital in for several months in order to farm effectively?

If so, are the assets you are farming with ones you want to hold long term or are you worried about short term price nukes? Are there ways to potentially qualify without having to commit capital if you have more time but less liquidity? (testnet users, earning discord roles, social campaign points)?

Are there ways to farm multiple airdrops at once with the same capital so you are more capital efficient with your farming (LRT and LST compound/airdrop lego strategies)

7/ Sustainability

If you choose to hold your airdrop (not recommended most of the time) and wish to see the value of your airdrop increase upon launch, you should probably pick something that:

Isn’t vaporware

Has a clear use case that is scalable and can be explained easily in 1 sentence

Has a clear short and long term roadmap with deliverables

A “strong” core team that has the competence and

Is receptive to feedback from the market and community and willing to be flexible and adapt

Strong VC backing to provide a considerable amount of runway

Blocmates is a good resources that provides many concise details and information around emerging products in the defi space.

They also have a solid substack that you can check out here:

8/ Pumpanomics

Don't undervalue the influence of a well-crafted cult. Cult communities have the power to inflate prices and create FOMO in projects.

Just to be clear, search for groups that are excited about the PROJECT rather than the airdrop.

Will all of your prospective airdrop farms fulfill each of these requirements?

Definitely not.

The goal here is to try and use this framework to identify which ones are most worthwhile. At the end of the day, the harsh reality is that you are subject to the criteria and distribution methods determined by the respective team, making it all the more important to diversify by participating in a multitude of different farms simultaneously.

As always, Stay Insightful